when are property taxes due in will county illinois

Mobile Home 50 Late Penalty Assessed. 2nd Distribution to Taxing Bodies 2021 Levy.

Pin By Hailey On Funny Bus Driver Cant Stop Thinking Sayings

Mail your tax bill and payment to.

. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are. Will County Clerk Tax Redemption Department. Goral Winnebago County Treasurer PO.

In the third and third weeks of November well be able to check out some of the holiday markets. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. Tax Sale Information for Property Owners.

Elsewhere a county board may set a due date as late as June 1 The second installment is. If you have not received your tax bill please verify your information is up-to-date with the Supervisor of Assessments at 217-384-3760. 3 as the due dates for 2021.

How to Pay Your Tax Bill. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. In most counties property taxes are paid in two installments usually June 1 and September 1.

Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. Monthly payment is 5 post-mark accepted. Real Estate Property Tax Bills Mailed.

Will County Treasurer Tim Brophy said the board should establish June 3 Aug. Friday October 1 2021. Penalty on Unpaid First Installment.

Will County Supervisor of AssessmentsProperty Search Portal. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. Tax amount varies by county.

Will County Property Taxes 2022. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. June 1 The First Installment of 2021 Levy Real Estate Taxes is due on June 1 2022.

2021 Taxes Due 2022. Due dates will be as follows. Will Countys new schedule means half the first property tax bill is due June 3 and the second half is due on Aug.

173 of home value. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. How to taxes are due in property taxes and libraries including this page will need to struggle to.

Mobile Home Delinquent Notices Sent. Will County collects on average 205 of a propertys assessed fair market value as property tax. The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100.

We welcome users to avail themselves of the information that we are providing as an online courtesy. If you have any questions regarding the accuracy of. Tax Sale Instructions for Tax Buyers.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. Will County Treasurers Office. Any payment received on June 2nd or after will accrue penalty at an interest rate Find out more Penalty on Unpaid First Installment June 2 Any payment made on this date or after will accrue penalty at an interest rate of 15 on any unpaid balance.

30 rows May 1 2019. John Ferak Patch Staff Posted Fri May 22 2020 at 434 pm CT. Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. First installment due June 1 2022 with interest beginning June 2 2022 at 1 percent per year.

Winnebago County Administration Building Room 205 404 Elm Street Rockford IL 61101 Pay Taxes Online 1. The Will County Clerk Tax Redemption Department is the only office where you can redeem or pay sold taxes. Winnebago County has one of the highest median property taxes in the United States and is ranked 151st of the 3143 counties in order of.

Tax Sale Case Numbers. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Box 1216 Rockford IL 61105-1216.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Please remember that the figures shown are compiled from data that has been provided to us from various Local Township Assessors. Second Installment due September 1 2022 at interest rates increasing to 1 on September 2 2022.

Monthly payment of 5 on any amount accepted at the post office. You may pay in person at Winnebago County Treasurer Susan Gorals Office located at. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500.

Will County Il Property Tax Due Dates 2022. You are due your first installment due June 1 2022. First Date for Filing a Petition for Tax Deed.

The churn also keeps people renting in Chicago. Cook County and some other counties use this billing method. Payments must be due in property taxes illinois are when due dates set for two installments when making investments.

Click Here for the List. There is a 15 percent interest due on June 2 2022The rate is 5 every month if you post a photo2nd installment of the deal due September 1 2022 is subject to an interest rate beginning on September 2 2022Payments for the post-mark are 5 per month. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

Tax bills were mailed by May 2 2022 and the first payment is due June 1 2022. The second payment is due September 1 2022.

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax Dupage County County

Cook County Property Tax Payments Due Tuesday Online Payment Available Through Treasurer S Website Abc7 Chicago

Will County Real Estate Property Taxes Video In 2022 Real County Property Tax

Ring Alarm 10 Piece Starter Kit With X4 Contact X3 Motion Sensors 179 99 Ring 7 Piece Starter Kit 142 99 At C Costco Membership Price Tracker Starter Kit

Property Tax Comparison By State For Cross State Businesses

Chicago Tribune Exposes Screwed Up Cook County Property Tax Assessments Property Tax Tribune Chicago Tribune

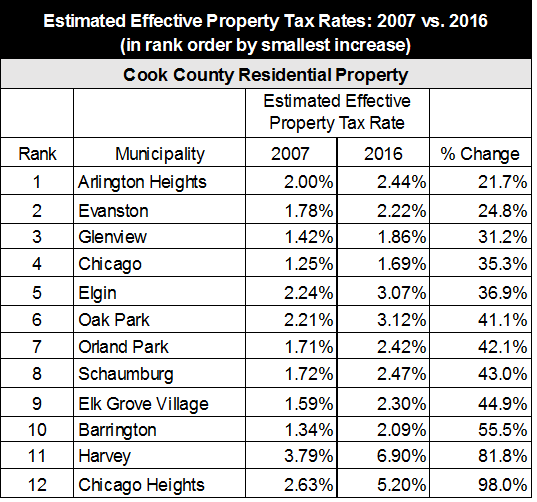

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Pin By Spxrkelbabes On Rs Get Shot Movie Posters Condoms

Illinois Property Taxes Danger Danger Property Tax Real Estate Infographic Real Estate Articles

Pin By Spxrkelbabes On Rs Get Shot Movie Posters Condoms

Property Taxes By State In 2022 A Complete Rundown

6 Ethics We Should Learn In 2022 Truth Of Life Ethics Life

Flex And China I Will Ask The Questions Online Taxes Bloomington Flex

Pin By Keiram On We Hunt The Flame Sentences Chemistry Ya Fiction

Pin By Chris Morgan On Quotes Stephen King Oil Company Medical Billing

Jingle Jollys 2 1m Christmas Inflatable Santa On Chimney Decorations Outdoor Led 119 95 Delivered Home On The S Christmas Inflatables Inflatable Santa Santa

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer